personal property tax car richmond va

2022 Personal Property Tax Rate - 380 per 100 of value on the following. This is an ad valorem tax based on the value of the vehicle.

Virginia Sales Tax On Cars Everything You Need To Know

The Personal Property tax rate for 2021 is 4 per 100 of assessed value.

. A higher-valued property pays more tax than a lower-valued property. Monday - Friday 8am - 5pm Mayor Levar Stoney. Use the map below to find your city or countys website to look up rates due dates.

On your Virginia Vehicle Property Tax paperwork you will have a Net Tax Amount to be Paid which is fully deductible. If a vehicle is not listed in the pricing guide the assessed value is calculated by depreciated cost. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year.

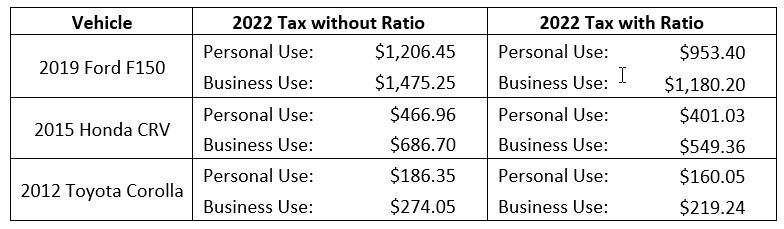

For most people this means automobiles trucks trailers boats motorcycles and recreational vehicles. A vehicle has situs for taxation in the county or if it is registered to a county address with the Virginia Department of Motor Vehicles. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief.

The personal property tax relief percentage for tax year 2021 is set at 28. As of December 31 st of the year preceding the tax year for which assistance is requested the. Another Virginia locality or from Out of State to avoid a 10 filing penalty of the full tax bill which includes the Car Tax Relief portion.

The rate is set annually by the York County Board of Supervisors in the month of May. The non-prorating locality will not assess the vehicle for property taxes until the next tax year. Is more than 50 of the vehicles annual mileage used as a business.

The minimum assessment is 12500. Henrico pushes car payment tax deadline to Aug. TAX RELIEF FOR THE ELDERLY AND DISABLED - REAL ESTATE.

The vehicle must be owned or leased by an individual and NOT used for business purposes. The assessment of personal property is made by the Commissioner of Revenue as of January 1 of each tax year. The tax rate shall be applied in full to that portion of the value in excess of 20000 for each qualifying vehicle.

King George County offers a high mileage program for vehicles. Since the taxable situs of the vehicle on January 1 was the City of Richmond the vehicle is subject to personal property taxes in the City of Richmond. The Henrico Board of Supervisors has voted unanimously to push back the deadline for personal property tax bills.

Therefore the vehicle is subject to. Right after that line will be a Local Registration Fee which is not deductible. If you sell or dispose of a vehicle s you.

Personal Property Tax. Those two numbers make up your Total Due. Virginia allows localities to tax the personal property of residents.

Other guides are used for. If you have questions about personal property tax or real estate tax contact your local tax office. In February Henrico also provided 20 million in real estate tax relief.

Finance Main Number 804. The property taxes on motor vehicles and trailers are prorated based on the date of purchase or the date the vehicle acquires taxable situs in the City of Richmond on an even month basis. The county estimates that residents would receive a 52-cent reduction to their 2022 personal property tax rate as a result.

And last updated 120 PM May 11 2022. Your tax bill is reduced by the applicable tax relief percentage for the tax year on the first 20000 that NADA values your vehicle. Richmond VA 23225 804.

1 Automobiles as described in subdivision A 3 of 581-3503. Personal Property Taxes are billed once a year with a December 5 th due date. Prorated Tax If you buy or sell a vehicle during the year the vehicle will be subject to a prorated tax.

Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. If a vehicle is subject to the taxes in Alexandria for a full calendar year the tax amount is determined by multiplying the tax rate by the assessed value. Proration of Personal Property Tax began January 1 1987 on all vehicles with the exception of boats boat motors personal water craft and mobile homes.

It is an ad valorem tax meaning the tax amount is set according to the value of the property. Answer the following questions to determine if your vehicle qualifies for personal property tax relief. It is possible that the portion of the total personal property tax on your vehicle that you have to pay may increase as the number of qualified vehicles in Henrico County increases.

Can you claim personal property tax on car in Virginia. Personal Property Registration Form An ANNUAL filing is required on all. A recognized pricing guide must be used for the assessed value.

Clarke County uses the National Automobile Dealers Association NADA annual guide for the trade-in value of vehicles. Tax rates differ depending on where you live. The tax is assessed by the Commissioner of the Revenue and collected by the Treasurer.

-- Those living in Henrico County will have more time to pay the first installment of their personal property tax bills after a vote on. The property owner must be at least 65 years of age or determined to be permanently or totally disabled by December 31 st of the year preceding the year for which assistance in required. If a vehicle is purchased before the 15th of the month that entire month counts in the proration of the vehicle for tax purposes.

Broad Street Richmond VA 23219. Personal Property Tax also known as a car tax is a tax on tangible property - ie property that can be touched and moved such as a car or piece of equipment. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons.

Dream Of Homeownership Slides Across The Uk Home Ownership New Home Developments Home

Soaring Home Values Mean Higher Property Taxes

Eliminating Virginia S Vehicle Property Tax Isn T Part Of Glenn Youngkin S Tax Relief Plan Wset

Liberty Military Housing E1 O9 Energy Efficient Homes Mechanicsburg Military Housing

/cloudfront-us-east-1.images.arcpublishing.com/gray/YLLABFQ235FWXILI5HMM7ZNGNQ.PNG)

Vehicle Supply And Demand May Lead To Higher Personal Property Taxes In Virginia

Pay Online Chesterfield County Va

With Used Car Values Up Some Northern Virginians Get Car Tax Relief Wtop News

Lowering Auto Insurance Rates Stretcher Com Save Money No Matter What Your Credit Score Autoi Cheap Car Insurance Getting Car Insurance Car Insurance Tips

Many Norfolk Taxpayers Seeing Increase In Personal Property Bills Wavy Com

Aba Tax Services Xero Accountant Property Business And S M S F Specialists Business Insurance Small Business Insurance Car Insurance

26 States That Won T Tax Your Social Security This Year Main Street Maine Michigan

Get The Title Of Property Reviewed Before Selling Title Insurance Title Buying A New Home

Upscale Yellow Spanish Style Stucco Home With Well Manicured Stucco Homes Spanish Style Homes Spanish Style

![]()

Aba Tax Services Xero Accountant Property Business And S M S F Specialists Business Insurance Small Business Insurance Car Insurance

Youngkin Signs Bill To Reclassify Certain Vehicles And Personal Property Tax Rates Wric Abc 8news

With Used Car Values Up Some Northern Virginians Get Car Tax Relief Wtop News

Many Left Frustrated As Personal Property Tax Bills Increase